BTC Price Prediction: Institutional Adoption to Drive Long-Term Growth Beyond $120,000

#BTC

- Institutional Adoption Acceleration - Growing corporate treasury allocations and banking infrastructure development creating sustained demand pressure

- Technical Consolidation Phase - Current price action suggesting accumulation near support levels before potential upward movement

- Macroeconomic Tailwinds - Global monetary expansion and digital asset integration supporting long-term valuation increases

BTC Price Prediction

Technical Analysis: BTC Shows Consolidation Signals Near Key Support

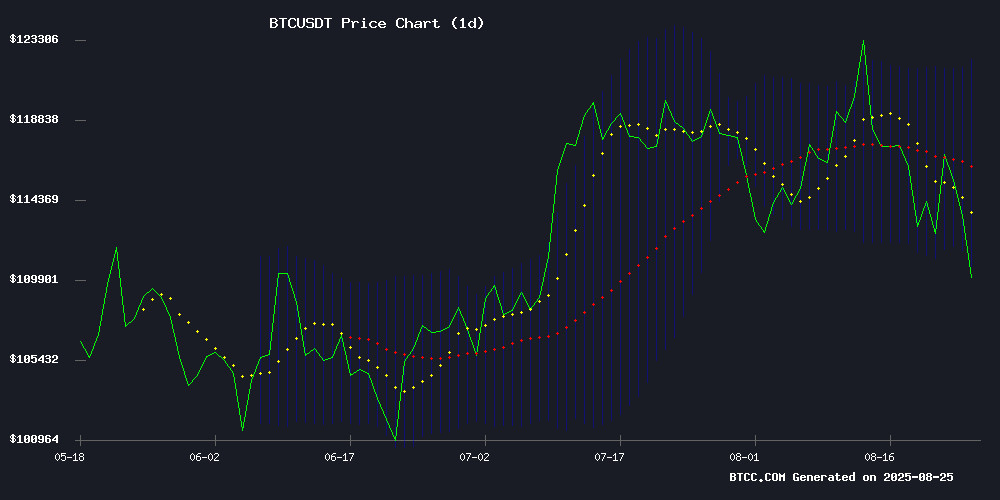

BTC is currently trading at $112,333, below its 20-day moving average of $116,576, indicating short-term bearish pressure. The MACD reading of 1,081.90 remains positive but shows weakening momentum as the histogram turns downward. Bollinger Bands suggest consolidation between $111,234 and $121,918, with the current price hovering NEAR the lower band.

According to BTCC financial analyst William: 'The technical setup suggests BTC is testing crucial support levels. A hold above $111,000 could pave the way for a retest of the $116,500 moving average, while a break below might see further correction toward $108,000.'

Market Sentiment: Institutional Accumulation Offsets Short-Term Weakness

Despite recent price corrections, institutional interest continues to grow with MicroStrategy expanding its holdings to $70 billion and Metaplanet increasing exposure. Bitcoin's capitalization reaching 2.2% of global M2 supply indicates broadening adoption, while developments like Anchorage Digital's venture arm launch signal long-term confidence.

BTCC financial analyst William notes: 'The institutional narrative remains strongly bullish despite technical weakness. Corporate treasury adoption and new banking infrastructure developments provide fundamental support that may outweigh short-term technical pressures.'

Factors Influencing BTC's Price

Bitcoin Eyes Rebound Above $110K as Institutional Interest Grows

Bitcoin shows signs of renewed bullish momentum after finding support near the $110,000 level. On-chain metrics indicate strong dip-buying activity, with $264 million in long positions liquidated in the past 24 hours alone. The market appears to be absorbing selling pressure without significant distribution from major holders.

Open interest data reveals a cautiously optimistic landscape. While whales remain on the sidelines, retail investors continue accumulating positions under 10 BTC. Institutional participation adds stability to current support levels, creating a foundation for potential upside.

CryptoQuant analysis suggests the pullback from Bitcoin's $124,000 all-time high may extend further. Yet the absence of sustained selling pressure leaves room for a bullish reversal. Market participants now watch whether this consolidation phase will resolve into another leg upward or require more time to establish a firmer base.

Bitcoin Capitalization Reaches 2.2% of Global M2 Supply Amid Institutional Surge

Bitcoin's market capitalization has eclipsed $2.22 trillion, now representing 2.2% of the global M2 money supply—a milestone underscoring its accelerating institutional adoption. MacroMicro estimates global M2 between $96.8 trillion and $105 trillion as of mid-2025, positioning Bitcoin as a growing component of global liquidity frameworks traditionally dominated by fiat currencies and gold.

The asset's fixed supply contrasts sharply with the expansionary policies of central banks, reinforcing its role as a digital counterpart to gold. Institutional demand has outpaced new issuance, driving Bitcoin's share higher. This trend reflects a broader shift toward decentralized assets in portfolios once reserved for traditional stores of value.

Anchorage Digital Launches Venture Arm to Back Early-Stage Crypto Protocols

Anchorage Digital, the institutional crypto custody firm, has unveiled Anchorage Digital Ventures—a strategic investment unit targeting early-stage blockchain protocols. The venture arm combines capital with hands-on expertise to co-build core infrastructure, Bitcoin DeFi solutions, and real-world asset platforms designed to meet Wall Street's compliance standards.

The initiative arrives as crypto venture funding contracts by 55%, with investors concentrating on selective seed and Series A opportunities. Anchorage aims to bridge the gap between visionary protocol teams and institutional adoption by providing liquidity strategy guidance, go-to-market support, and regulatory alignment.

"From sorting out liquidity strategy to institutional exposure, even breakthrough ideas stall without scalable execution," the company stated in its announcement. The move signals Anchorage's evolution from pure custody provider to active participant in protocol development.

Bitcoin On-Chain Data Reveals Shift Toward Smaller, More Frequent Transactions

Bitcoin's network activity shows a notable divergence between transaction volume and token value. Daily transactions surged 11.45% to 439,534 in the past 30 days compared to the 2025 average, while the total BTC moved fell 6.69% to 588,180 tokens. This suggests a market increasingly dominated by smaller transfers among fewer participants.

Active addresses dipped slightly to 928,141 (-1.86%), yet prices defied the trend with a 15.81% rally to $116,537. The paradox deepens as reported volumes dropped 15.96% to $23.92 billion daily—painting a picture of concentrated activity where more transactions move less value.

MicroStrategy Continues Bitcoin Accumulation Amid Market Volatility

MicroStrategy has added another 430 BTC to its corporate treasury, bringing its total holdings to 629,376 BTC valued at approximately $51.4 million. The purchase comes during a period of heightened volatility in Bitcoin markets, with prices fluctuating significantly over recent weeks.

Michael Saylor's firm now sits on unrealized gains exceeding $25.8 billion, demonstrating the success of its long-term Bitcoin accumulation strategy. The company executed its latest purchase through over-the-counter (OTC) transactions to minimize market impact, according to corporate treasurer Shirish Jajodia.

Market observers note that MicroStrategy's continued accumulation signals institutional confidence in Bitcoin's long-term value proposition, despite short-term price movements. The company's total BTC holdings now represent approximately 3% of the total circulating supply.

Bitcoin Targets $120,000 as Metaplanet Expands Holdings Despite Price Dip

Bitcoin faces short-term pressure but maintains strong institutional demand, with Metaplanet continuing its accumulation strategy. The firm purchased an additional 103 BTC worth $12 million, bringing its total holdings to 18,991 BTC valued at $2.2 billion. Analysts identify $112,000 as a critical support level, suggesting a potential breakout toward $120,000 if stability persists.

Metaplanet's steady accumulation underscores long-term confidence in Bitcoin, even as the price dipped 2.07% to $112,516. Trading volume remains robust at $62.06 billion over 24 hours, with a market cap of $2.25 trillion.

Crypto-Friendly Xapo Bank Hires Former FalconX Executive as Head of Relationship Management

Xapo Bank, a Gibraltar-based institution regulated by the GFSC, has appointed Tommy Doyle as its new head of relationship management. Doyle brings a wealth of experience from both traditional finance and crypto sectors, having held senior roles at FalconX, Coinbase, and Wall Street giants like Goldman Sachs and Citi.

The move signals Xapo's continued push into digital asset services, following its launch of bitcoin-backed loans earlier this year. Doyle's London-based position will likely focus on expanding institutional relationships for the crypto-friendly bank.

Bitcoin Faces Intensified Correction Despite Fed's Dovish Signals

Bitcoin's rally faltered abruptly after a brief surge fueled by Federal Reserve Chair Jerome Powell's暗示 of potential September rate cuts. The cryptocurrency initially climbed $5,000 following Powell's Jackson Hole speech, only to relinquish gains and breach critical support levels.

The 8-hour chart reveals BTC testing the $110,650 zone after failing to sustain momentum. Market technicians now watch the $109,000 support level—a make-or-break threshold that could determine whether the correction deepens or reverses. The Stochastic RSI suggests oversold conditions may soon trigger a bounce.

This volatility underscores crypto markets' hypersensitivity to macro cues, where even dovish Fed positioning can't override technical selling pressure. The rapid rejection at higher levels signals persistent bearish sentiment among traders despite favorable monetary policy winds.

U.S. Stocks Retreat as Focus Shifts to Nvidia Earnings; Bitcoin Mirrors Equities Decline

Wall Street opened the week on a subdued note, with the Dow Jones Industrial Average slipping 90 points and the S&P 500 shedding 0.2%. The Nasdaq Composite followed suit, dropping 0.3% as investor optimism around potential Fed rate cuts waned. This pullback comes after a rally last week that pushed the Dow to a record close of 45,631.

Bitcoin mirrored the downward trajectory of traditional equities, retreating to near $111,000 after briefly touching $117,000 during Friday's risk-asset surge. The cryptocurrency had peaked above $124,000 earlier this month but remains sensitive to broader market sentiment.

All eyes now turn to corporate earnings, particularly Nvidia's upcoming report, which could set the tone for tech and growth stocks. The chipmaker's performance is seen as a bellwether for both traditional markets and crypto sectors given its central role in AI and computing infrastructure.

Strategy Expands Bitcoin Holdings to $70 Billion with $357 Million Purchase

Strategy has added 3,081 BTC to its treasury at an average price of $115,829 per Bitcoin, bringing its total holdings to 632,457 BTC worth over $70 billion. The acquisition, disclosed in an SEC filing, was funded through equity sales proceeds.

The August buying pace of 3,666 BTC marks a slowdown from July's aggressive accumulation of 31,466 BTC. This tactical shift suggests a more measured approach to capital allocation amid evolving market conditions.

As one of the largest corporate holders of Bitcoin, Strategy's continued accumulation reinforces institutional confidence in crypto's long-term value proposition. The purchases were executed between August 18-24, demonstrating ongoing dollar-cost averaging despite recent price volatility.

Trump Adviser David Bailey Predicts Extended Bull Market, Highlights Institutional Crypto Adoption

David Bailey, founder of Bitcoin Magazine and key advisor to Donald Trump's campaign, asserts that the crypto bear market remains years away. Institutional adoption is accelerating, with sovereign funds, banks, and pension managers now accumulating Bitcoin at scale. Combined institutional holdings exceed $100 billion, dominated by $BTC.

Bailey draws parallels to gold's post-ETF boom in the early 2000s, suggesting a multi-year rally ahead. While analysts like CK Zheng warn of potential macro shocks, the consensus tilts toward a more resilient market structure. The institutional wave has barely begun—Bitcoin's addressable market remains largely untapped.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, BTC is positioned for significant long-term appreciation despite near-term volatility. Institutional adoption, expanding banking infrastructure, and increasing global allocation suggest sustained upward momentum.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $150,000 | $180,000 | ETF inflows, institutional adoption |

| 2030 | $250,000 | $350,000 | $500,000 | Global reserve asset status, scarcity premium |

| 2035 | $500,000 | $750,000 | $1,200,000 | Network effects, digital gold narrative |

| 2040 | $800,000 | $1,500,000 | $2,500,000 | Full institutional integration, store of value |

William from BTCC emphasizes: 'These projections assume continued institutional adoption and macroeconomic conditions favoring hard assets. Short-term volatility should be expected, but the long-term trajectory appears strongly positive.'